Combating AI-Generated Receipt Fraud with Spend Control

AI receipt fraud is all over the news. TechRadar recently reported that fake AI-generated receipts made up 14% of fraudulent documents submitted in September 2025.

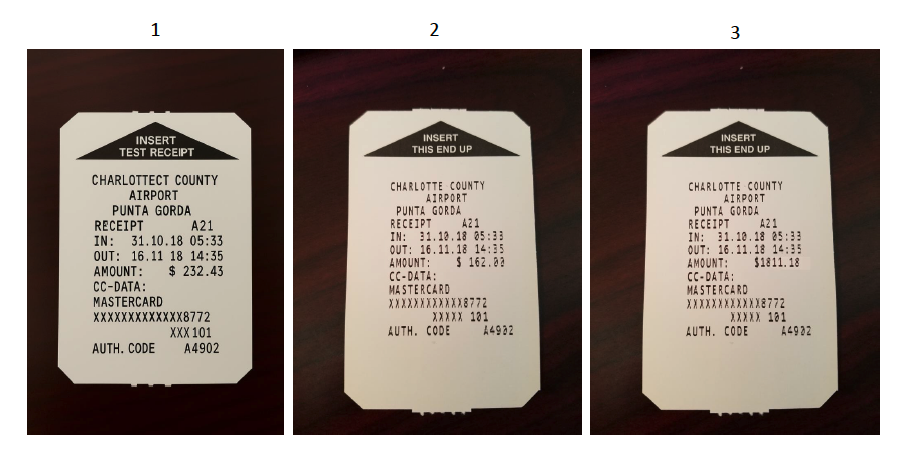

Can you spot the fake receipt below?

While AI makes fraud more visible, the deeper issue is that many organizations are still relying on expense workflows designed long before modern digital fraud existed. These outdated processes leave gaps that attackers can exploit.

AI-generated receipts are becoming increasingly realistic, and although detection tools continue to improve, they cannot keep pace. Detection alone will never be fully reliable, because it happens after spend has already occurred. Any workflow based on “review receipts → determine authenticity” will always introduce risk, manual effort, and uncertainty.

This isn’t a failure of your team or of your tools. It’s a limitation of the reimbursement model itself.

Fake Receipts Aren’t the Root Cause; The Workflow Is.

Organizations that still rely on spreadsheets, email receipts, manual reimbursements, or partially connected ERPs are more likely to encounter errors, exceptions, and fraud attempts. Fake receipts are usually a symptom, not the source. They indicate that the expense environment has difficulty verifying documentation and authenticating financial records.

Common challenges in these environments include:

-

Limited upfront controls

-

Heavy reliance on manual review

-

Data spread across multiple systems

-

Policies enforced after spend occurs

-

Increased risk of fraudulent receipt submission due to weak controls

Most reimbursement workflows still follow one path:

“Spend first → upload a receipt → wait for someone to verify it.”

This means finance teams must validate transactions after money has already left the organization. Even when digitized, this workflow leaves room for delays, mistakes, and inconsistent oversight.

Removing Friction From Expense Operations

While fraud gets attention, day-to-day operational drag is what slows teams down:

-

Extended reconciliation cycles

-

Chasing missing receipts

-

Inconsistent or delayed card feed data

-

Approval bottlenecks

-

Limited visibility until month-end

These issues occur because the system requires continuous manual intervention. This not only slows internal operations but can also impact the accuracy and consistency of financial reporting.

The Shift From Reactive Detection to Controlled Spend

AI tools can identify anomalies, forged metadata, and structural inconsistencies in documents. But this still happens after transactions occur.

A more effective approach is to reduce dependence on receipts altogether by controlling spend at the moment it happens. This is where structured, controlled spend systems provide significant advantage.

Using a commercial card, organizations can:

-

Limit where and how cards may be used

-

Restrict purchases to defined vendors or categories

-

Set role-based spend limits

-

Control card usage by date or location

-

Automate approvals and data capture

When purchases occur within predefined controls, the opportunity for fraudulent receipt submission is dramatically reduced. This improves data quality, strengthens audit readiness, and decreases reconciliation work.

Controlled Spend Minimizes Risk and Operational Drag

A controlled spend environment also eliminates many repetitive tasks:

-

No more chasing receipts

-

No more manual audits of transactions

-

No more fragmented data across systems

-

No more month-end surprises

Expenses flow directly into finance systems in a categorized, compliant, policy-aligned manner, reinforcing trustworthy financial processes.

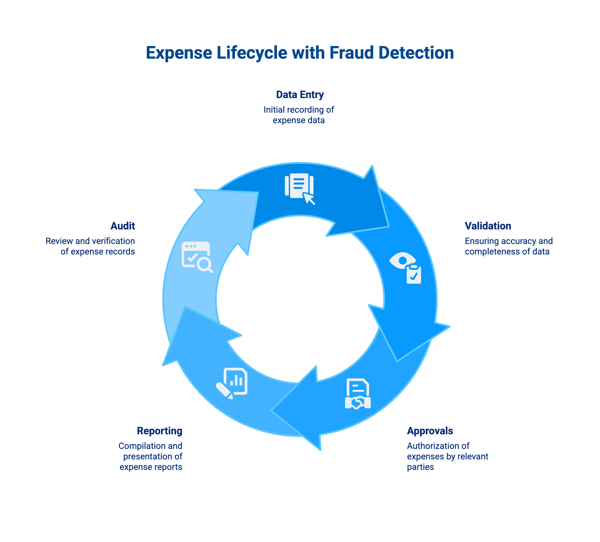

.png?width=600&height=558&name=Fraud%20Detection%20in%20the%20Expense%20Lifecycle%20-%20visual%20selection%20(19).png)

In practice, this means using structured card programs, which prevent out-of-policy transactions at the point of purchase. If an employee attempts a transaction at an unallowable merchant, the transaction will not proceed.

You can learn more about how DATABASICS supports this model here.

If You’re Still Using Spreadsheets, Modernization Has the Biggest Impact

Many finance teams still rely on spreadsheets for coding, reconciling, or validating expenses. While common, spreadsheets provide limited control and introduce higher risk. Adding AI scanning on top of spreadsheets simply layers complexity onto a system that lacks foundational safeguards.

Modern expense platforms apply policy rules before spend occurs and integrate directly with ERPs. They also automate coding, categorization, tax rules, and exception workflows, all of which create a controlled environment where fraud becomes harder and reconciliation becomes faster.

.png?width=800&height=547&name=Fraud%20Detection%20in%20the%20Expense%20Lifecycle%20-%20visual%20selection%20(5).png)

Build a System Where Fake Receipts Can’t Enter in the First Place

If your workflow still relies on employees uploading receipts for verification, the burden falls on your team. More advanced organizations are shifting toward real-time spend shaping rather than reactive documentation review.

When authentication and controls are applied at the moment an expense is created, opportunities for manipulation decrease. This is exactly what DATABASICS delivers: automated controls, real-time verification, and consistent compliance guardrails built into every step.

Book a demo to see how DATABASICS strengthens your controls from the moment expenses enter your system.

See How Modern Fraud

Detection Really Works

AI generated receipts are flooding finance teams. Most tools cannot keep up. Get a practical guide that explains the real risks, how detection works, and what steps give you control. This white paper breaks it down with clear examples and proven methods.

Subscribe to our blog

Recent Posts

Posts by Topics

- Expense Management Software (130)

- DATABASICS (69)

- Time Tracking Software (47)

- Leave Management System (26)

- P-Cards (9)

- Home Healthcare (8)

- Government Contractors (7)

- Nonprofit Organizations (7)

- International Development (6)

- Receipt Management (6)

- Advanced OCR (2)

- CROs (2)

- Staffing Agencies (2)

- Vendor Invoice Management (2)

- Audit Management Software (1)

- Construction (1)

- Field Service Management (1)

- Integration (1)

- Microsoft Dynamics (1)

- Oracle NetSuite (1)

- Partnerships (1)

- Professional Services (1)

Read on

Expense Fraud Isn’t New Because of AI; It’s a Systems & Operational Problem

Read Now

Enhancing Employee Experience with Mobile Expense Management

Read Now

Maintaining Compliance with Mobile Expense Management Tools

Read NowSeamless Integration of Time Tracking and Payroll

Read Now

Seamless Migration from Nexonia: Unified Time and Expense Solutions

Read Now

Nexonia Migration: The Best Alternative for Timesheets & Expense Management

Read Now

Subscribe to Our Blog

Subscribe to our blog and get the latest in time tracking and expense reporting news and updates.