How to Stay Compliant with Earned Sick Time Laws

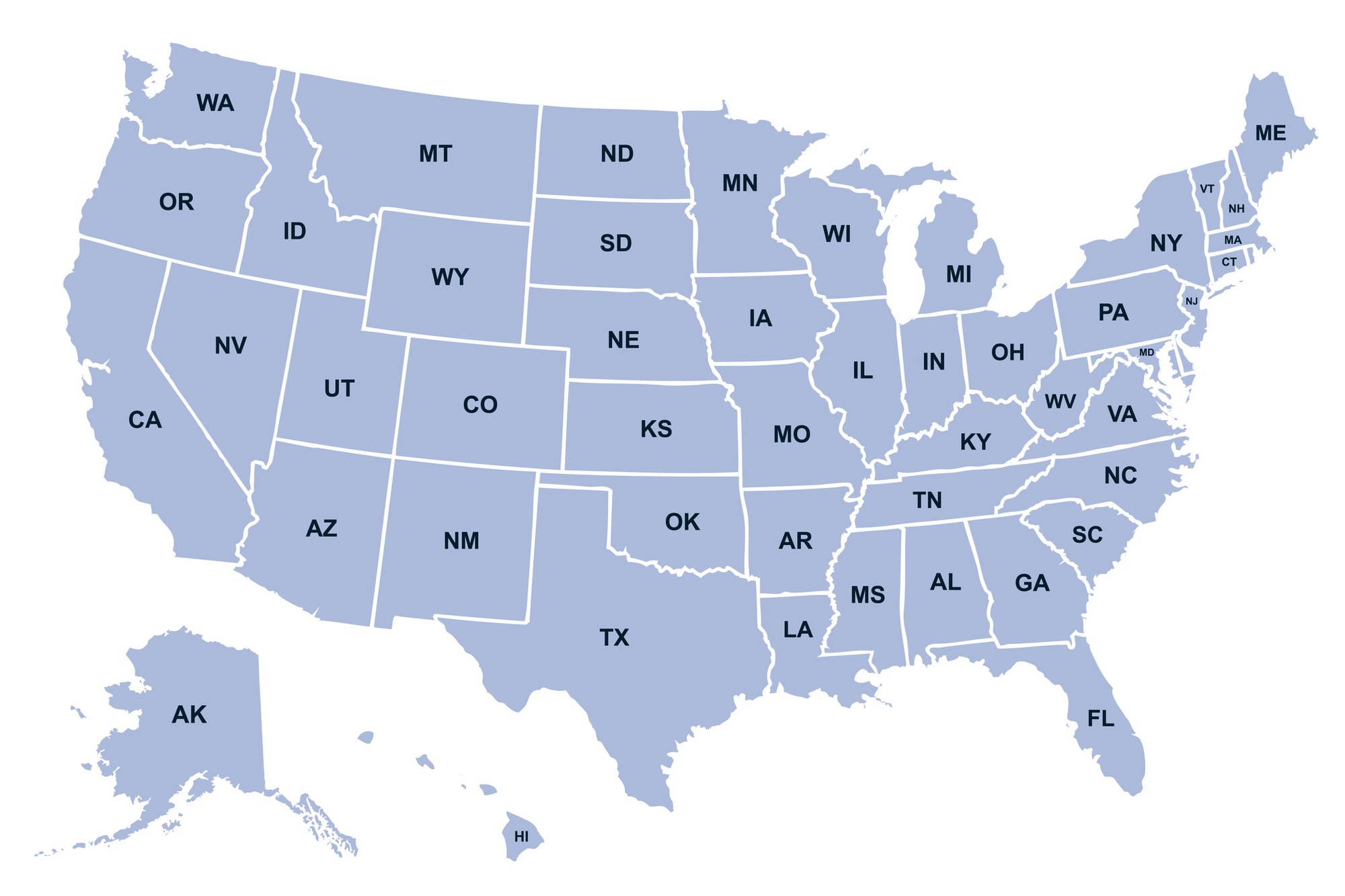

In February 2025, the Michigan Supreme Court reinstated the original provisions of the Earned Sick Time Act ("ESTA") from 2018. This change amends the existing Earned Sick Time Act and will expand paid sick leave. Missouri and Nebraska are scheduled to follow suit later this year, joining a growing list of states and local authorities requiring employers to provide their employees with paid time off from work to address health needs.

What is ESTA?

ESTA is a labor law that guarantees employees the right to accrue and use paid sick leave based on hours worked, with specific requirements for different business sizes and employee classifications. Specifically, the law requires that employees of small businesses accrue at least one hour of sick time for every 30 hours worked and must be allowed to use their paid sick time before any unpaid sick time. For all other employees, the law requires accrual of at least one hour of paid sick time per 30 hours worked, with usage limited to 72 hours annually unless the employer permits more.

Overview of State-Specific Earned Sick Time Laws

As paid sick leave mandates expand across the U.S., states like Michigan, Missouri, and Nebraska are leading the charge with new laws in 2025, joining states like California and New York with established requirements. Michigan’s Earned Sick Time Act (ESTA), effective February 2025, mandates 1 hour of paid sick time per 30 hours worked, with a usage cap of 72 hours annually unless employers allow more. Missouri and Nebraska are set to implement similar laws later this year, though exact details—like accrual rates and eligibility—may differ.

For comparison, California’s law allows employers to front-load 24 hours of sick time annually, while New York requires up to 56 hours based on business size. These variations highlight the need for employers to understand local nuances, such as eligibility exemptions (e.g., small businesses or part-time workers) and carryover limits. Multi-state employers, in particular, must adapt policies and tracking systems to stay compliant with each jurisdiction’s unique requirements. Given these varying requirements across states, employers often face significant challenges in staying compliant.

Common Challenges Employers Face

Managing ESTA requirements can be complicated for employers, especially when tracking different accrual rates, balancing paid versus unpaid time, and ensuring compliance with usage limits across various employee classifications. Complying with state and local earned sick time laws presents several hurdles for employers. Tracking varying accrual rates—such as Michigan’s 1 hour per 30 hours worked—across different employee classifications and locations is a logistical challenge, often leading to calculation errors.

Balancing paid versus unpaid leave, especially when usage caps like ESTA’s 72-hour limit apply, adds complexity. Many businesses also struggle with maintaining accurate, audit-ready records, a requirement that becomes overwhelming without automation. Additionally, navigating eligibility exemptions (e.g., small businesses or probationary employees) and inconsistent probationary period rules can lead to unintentional violations. These issues, if mismanaged, risk penalties, employee disputes, and reputational damage, making compliance a daunting task for employers without the right systems in place.

Best Practices for Compliance

In addition to ensuring that sick leave policies are updated to reflect statutory requirements and communicated to employees, employers should also consider adopting a leave management solution to support and manage these requirements. Employers need a reliable timekeeping tool for ESTA compliance because the law mandates precise tracking of hours worked, accurate calculation of sick time accruals, proper categorization of paid versus unpaid leave, and enforcement of annual usage limits—all of which must be documented for potential audits.

Because the requirements differ by location, your solution must have the flexibility to accommodate location-specific requirements, such as:

- Eligibility: Not all employees qualify for paid sick time in all locations. Exceptions can be based on company size/revenue, industry, employee types, and/or number of worked days/hours.

- Accrual Types: Most legislation suggests that sick time is earned based on hours worked. Typically, employers are allowed to “front load” balances, combining sick and vacation time into a single PTO category.

- Probationary Periods: Local requirements vary related to probationary periods, including the length of such periods and the employee's right to earn sick time during this period.

- Accrual Rates: The most common accrual rate across localities is 1 hour earned per 30 hours worked, but this can vary.

- Accrual Limits: Most jurisdictions cap how much sick time can be accrued or carried over from one year to the next.

- Usage Rules: There are local guidelines for how employees can use their sick time.

To navigate state and local earned sick time laws effectively, employers can adopt several key practices. First, review and update leave policies to align with specific requirements, such as Michigan’s ESTA or upcoming Missouri and Nebraska mandates, ensuring clarity on accrual rates and usage limits. Second, train HR teams and managers on local regulations to prevent missteps in eligibility or documentation. Third, implement a flexible leave management system to automate tracking of hours worked, sick time accruals, and leave usage, reducing errors and ensuring audit readiness. Finally, communicate policies transparently to employees, outlining their rights and procedures. These steps streamline compliance, minimize risks, and foster a supportive workplace. A key component of these best practices is using technology to simplify compliance.

Benefits of Using a Leave Management Solution

The need to maintain accurate records of hours worked, time accrued, and sick leave taken creates a significant administrative burden that can lead to compliance issues if not properly managed. Without an automated solution, businesses face significant administrative burdens, risk calculation errors, struggle with maintaining required records, and may incur penalties for non-compliance, making a dedicated timekeeping system an essential investment for efficiently managing these complex requirements while ensuring legal compliance.

A dedicated timekeeping solution simplifies compliance with earned sick time laws by automating complex tasks. It accurately tracks hours worked and calculates accruals—such as 1 hour per 30 hours under ESTA—eliminating manual errors. Employers benefit from seamless categorization of paid versus unpaid leave, ensuring usage aligns with caps like 72 hours annually. These solutions also generate audit-ready reports, reducing administrative stress and legal risks. With flexibility to adapt to location-specific rules, integration with accounting, HR, and payroll systems (like Sage, NetSuite, and Microsoft Dynamics), and real-time data access, a solution like DATABASICS saves time, boosts efficiency, and keeps businesses compliant effortlessly.

DATABASICS offers a complete Leave Management solution that helps employers automate managing and tracking earned sick time, supporting compliance with state and local laws. It integrates with your existing HR, payroll, and accounting systems for seamless management.

FAQs About Earned Sick Time Laws

What is Michigan’s ESTA?

Michigan’s Earned Sick Time Act (ESTA), effective February 2025, requires employers to provide 1 hour of paid sick time per 30 hours worked, with a usage cap of 72 hours annually unless more is allowed.

Who qualifies for paid sick time under ESTA?

Most employees qualify, but exemptions may apply for small businesses (based on size/revenue), certain industries, or workers with limited hours, depending on local rules.

Can employers front-load sick time?

Yes, many laws, including ESTA, allow front-loading sick time (e.g., combining it with vacation into PTO) as an alternative to accrual, if minimum requirements are met.

How much sick time can employees accrue?

Accrual rates vary—typically 1 hour per 30 hours worked—but most states cap total accrual or carryover, such as 72 hours under ESTA.

What happens if I don’t comply with sick leave laws?

Non-compliance can lead to penalties, back pay owed to employees, legal disputes, and audits, depending on the jurisdiction.

Get in Touch with Us

Contact us for a demo to see how DATABASICS simplifies sick time and leave management while ensuring compliance.

Subscribe to our blog

Recent Posts

Posts by Topics

- Expense Management Software (130)

- DATABASICS (69)

- Time Tracking Software (47)

- Leave Management System (26)

- P-Cards (9)

- Home Healthcare (8)

- Government Contractors (7)

- Nonprofit Organizations (7)

- International Development (6)

- Receipt Management (6)

- Advanced OCR (2)

- CROs (2)

- Staffing Agencies (2)

- Vendor Invoice Management (2)

- Audit Management Software (1)

- Construction (1)

- Field Service Management (1)

- Integration (1)

- Microsoft Dynamics (1)

- Oracle NetSuite (1)

- Partnerships (1)

- Professional Services (1)

Read on

Expense Fraud Isn’t New Because of AI; It’s a Systems & Operational Problem

Read Now

Enhancing Employee Experience with Mobile Expense Management

Read Now

Maintaining Compliance with Mobile Expense Management Tools

Read NowSeamless Integration of Time Tracking and Payroll

Read Now

Seamless Migration from Nexonia: Unified Time and Expense Solutions

Read Now

Nexonia Migration: The Best Alternative for Timesheets & Expense Management

Read Now

Subscribe to Our Blog

Subscribe to our blog and get the latest in time tracking and expense reporting news and updates.