Managing receipts within expense reports has never been simpler with automated expense report software. Capturing receipts is literally a “snap” with these receipt management best practices:

Expense report receipt capture best practices

- Create a standard for what information you need.

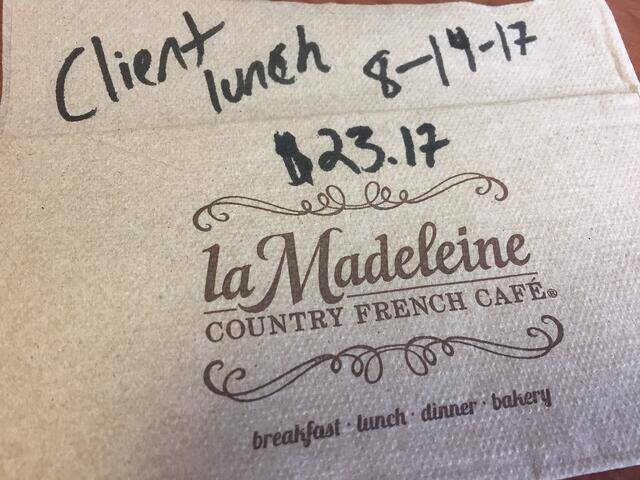

Once employees understand exactly what information you need, you can begin to get organized. Start by considering what kinds of data you need to collect about the expense, like date, vendor name, vendor type, expense type, total amount, and the kind of receipts that you will accept.Beyond this, you might also consider what information the receipt needs in order to constitute a real receipt. For example, would you accept this napkin as a receipt?

Probably not. Avoid this situation by making it clear exactly what kind of information you need from the receipt so that employees can comply with that requirement.

- Accept digital receipts.

Another best practice is to allow pictures of receipts to be submitted in lieu of the actual paper receipt. You can also accept PDFs and even emails of receipts.When pictures become an option, it’s easy to store and track receipts with a quick snap on your phone.

Related Article: Funny Receipt Fails We’ve Seen & Collected

- Get a system with OCR (optical character recognition).

An expense software provider that uses OCR allows you to just take a picture of the receipt and let the system fill in the blanks for you. All you have to do is make sure that the auto-fill is correct and hit submit.

- Leverage email receipts.

Some employees will commit expense report fraud because they know that their approver is overwhelmed with other tasks and doesn’t have the time or patience to go through every expense for every employee. They’ll use this knowledge to sneak in expenses and seek reimbursement.

Then, these emails are converted into PDFs and stored in a Receipt Repository (or other storage area for your receipts). Then, when it’s time to submit your receipt, it’s easy to find it in your repository and attach it to your expense report.

- Report on missing receipts

At the end of the expense reporting process, your provider should provide you with the tool to perform reporting and analytics on which expense reports were missing a receipt. These are good opportunities to look closer at the expense report and look for possible fraud.

These receipt management best practices will ensure that your company remains organized and takes advantage of all the possibilities allowed by expense reporting software. Learn more about what automated receipt capture & management can do for your organization.

For more information on the DATABASICS Time & Expense solutions, contact us, or call (800) 599-0434.

DATABASICS provides cloud-based, next generation Expense Reporting, P-Card Management, Timesheet Management, Leave Management, and Invoice Processing automation. Specializing in meeting the most rigorous requirements, DATABASICS offers the highest level of service to its customers around the world.

DATABASICS is relied upon by leading organizations representing all the major sectors of the global economy: financial services, healthcare, manufacturing, research, retail, engineering, nonprofits/NGOs, technology, federal contractors, and other sectors.

Connect with DATABASICS: LinkedIn, Twitter, and YouTube. DATABASICS is headquartered in Reston, VA.