People still ask, “Do you need original receipts for expense reporting?” By “original receipts,” they usually mean physical receipts or paper receipts. Regardless of how you refer to them, the short answer is thankfully, “No!”

Electronic receipts are perfectly acceptable in almost all situations, especially when using online expense software. Generally, you attach purchase receipts—whatever their format—to expense reports to substantiate business expenditures for three purposes:

- Business income taxes

- Employee expense reimbursement

- Expense reimbursement of your company by your customers, as may be provided for by your contracts

Regarding business income taxes, business travel spend and other categories of employee expense are deductible if they can be shown to be “ordinary and necessary.” A typical point-of-sale receipt for a transaction that specifies date, location, vendor, the items purchased, and the financial details is the standard for documentation. However, the IRS is increasingly open to indirect proof like credit card statements and bank statements. What’s more, for purchases under $75.00, the “Cohan rule” applies. This means you do not need specific evidence of a purchase so long as the deduction claim is for an “ordinary and necessary” business expense.

Related Article: Funny Receipts & Expense Report Fails

The IRS rules do not cover employee reimbursement. Employee expense management policies intended to ensure that travel spend and other employee spend adhere to IRS standards for expense deductibility may not work well with respect to employee expense reimbursement. Organizations, for example, will probably not want to apply the Cohan rule in these situations. A policy of “no questions asked” for under $75 expense claims would tax the integrity of all but a few organizations’ workforces. On the other hand, organizations cannot unreasonably “tighten the screws” to discourage employees from applying for legitimate expense reimbursement. For example, under California Labor Code § 2802(a):

“An employer shall indemnify his or her employee for all necessary expenditures or losses incurred by the employee in direct consequence of the discharge of his or her duties, or of his or her obedience to the directions of the employer…”

Practically speaking, California employers are ultimately accountable to the state for expense reporting reimbursement requirements. The final say on expense substantiation is not the organization’s reimbursement policy guide. A paper receipt mandate, while acceptable to the IRS, might fail in California courts.

No special protections have been enacted against intentionally cumbersome expense reporting procedures for reimbursement of vendors by their customers. Here you might see contractual provisions requiring attachment of original receipts to expense vouchers among other ploys intended to delay reimbursements and increase the cost of filing to the point that small claims are absorbed by the vendor.

In summary, expense reporting has advanced to where electronic receipts are the norm. Paper receipts are actually in disrepute, especially for reimbursements. This is potentially an illegal encumbrance by employers under certain circumstances in California and an increasingly rare contractual term between companies that will not be missed. Digital receipts are now part of everyday business, which makes it easy to use online expense report software. Expense management automation simplifies expense compliance when it comes to the regulations of all kinds, including California’s requirements.

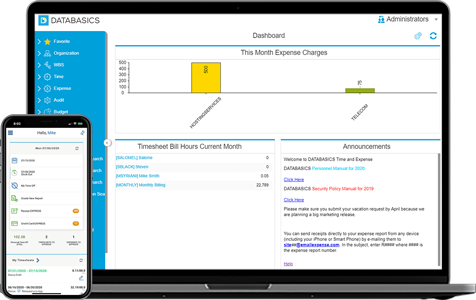

Learn more about DATABASICS and how we help organizations like yours better manage their expense reporting and time tracking challenges:

For more information on the DATABASICS Time & Expense solutions, contact us, or call (800) 599-0434.

DATABASICS provides cloud-based, next generation Expense Reporting, P-Card Management, Timesheet Management, Leave Management, and Invoice Processing automation. Specializing in meeting the most rigorous requirements, DATABASICS offers the highest level of service to its customers around the world.

DATABASICS is relied upon by leading organizations representing all the major sectors of the global economy: financial services, healthcare, manufacturing, research, retail, engineering, nonprofits/NGOs, technology, federal contractors, and other sectors.

Connect with DATABASICS: LinkedIn, Twitter, and YouTube. DATABASICS is headquartered in Reston, VA.